Fast cash loans up to RM10,000 today!

How to apply for a loan?

How to apply for a loan?

Step 1

Apply online

Apply online

Select your loan amount

Select your loan amount

Enter your phone number and verify via OTP

Enter your phone number and verify via OTP

Submit a short application form

Submit a short application form

Step 2

Receive approval

Receive approval

Get approved in just 5 minutes

Get approved in just 5 minutes

Confirm your details via a phone call if needed

Confirm your details via a phone call if needed

Step 3

Get your money quickly

Get your money quickly

Receive an instant money transfer

Receive an instant money transfer

Access funds from any bank account

Access funds from any bank account

Am I eligible for a loan?

Am I eligible for a loan?

resident of Malaysia

employed

resident of Malaysia

employed

Why Choose Us?

Why Choose Us?

Online process

Money same day

Fully licensed

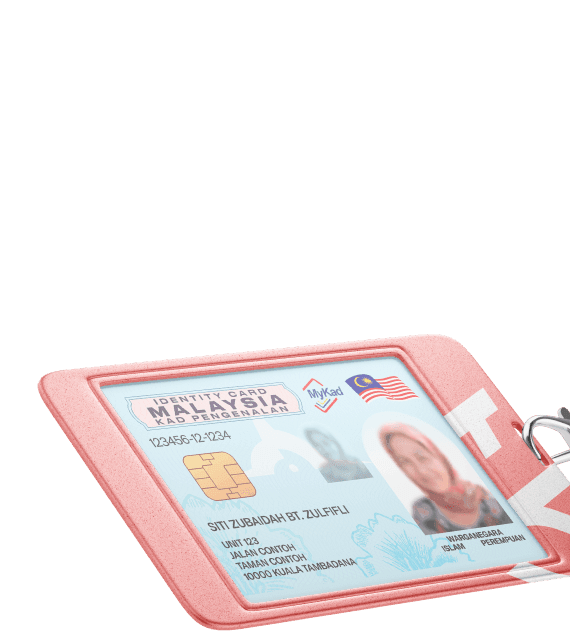

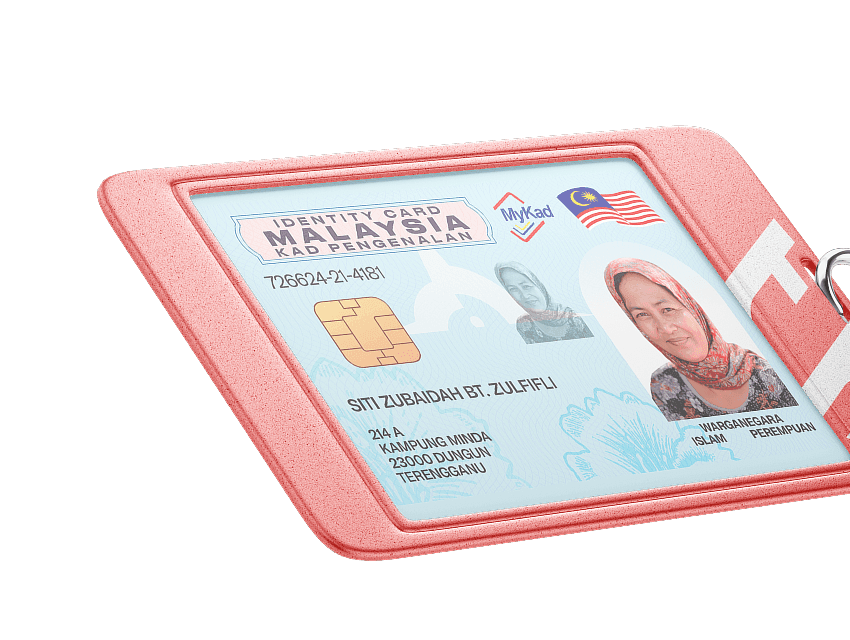

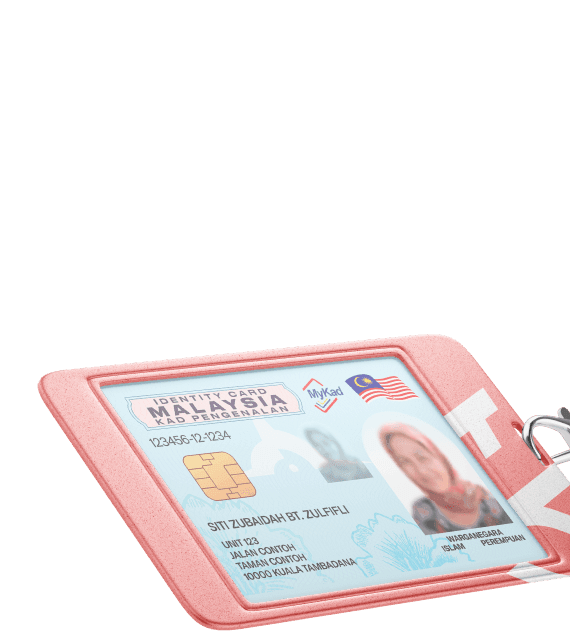

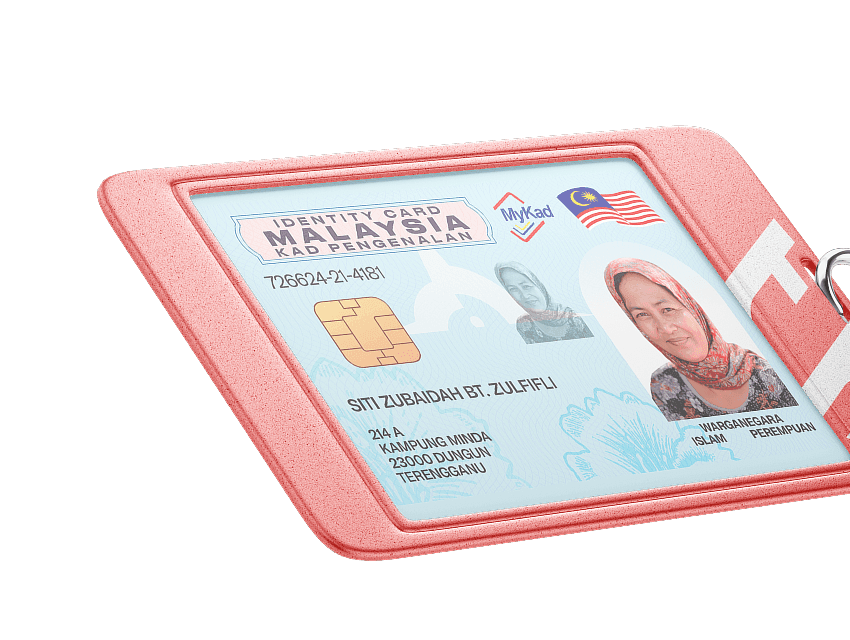

Only MyKad required

Our partners:

Our partners:

Paying made easy

Paying made easy

Explore us on RinggitPlus

Explore us on RinggitPlus

More features in the App

More features in the App

Increased chances of approval

Increased chances of approval

Easier way to apply and to make payments

Easier way to apply and to make payments

More favorable conditions

More favorable conditions

Special offers and promotions

Special offers and promotions

License & FAQ

License & FAQ

Can you provide details about Tambadana's Online Personal Loan (OPL) service?

Can you provide details about Tambadana's Online Personal Loan (OPL) service?

Wawasan Cojaya Sdn Bhd, with its registration number 201401047621 (1123810-P), is honored to have been selected by the Ministry of Housing and Local Government (KPKT) to provide online money lending services starting 27th March 2024, making us a prominent member of the Malaysian Credit Community. The initiative for online money lending, introduced by KPKT on 13th November 2020, responds to the public's increased demand for financial aids and the government's ambition to harness the 4.0 industrial revolution's technological advancements. Our OPL platform ensures secure and convenient financial transactions without the need for physical presence, leveraging technologies like OTP (one-time-password), e-KYC (electronic Know Your Customer), and digital certificates recognized by the Malaysian Communications and Multimedia Commission (MCMC) for borrower verification, agreement security, and data protection, fully compliant with KPKT guidelines.

What is a personal loan?

What is a personal loan?

A personal loan in Malaysia is a financial product offered by banks and financial institutions that allows individuals to borrow a fixed amount of money and repay it with interest over a predetermined period.

Unlike specific loans such as home or car loans, a personal loan can be used for a variety of purposes, including:

- • Debt consolidation – combining multiple debts into a single loan to reduce interest rates and simplify repayments.

- • Home renovation – covering expenses for improving or upgrading a home.

- • Medical emergencies – paying for unexpected medical treatments or surgeries.

- • Education – financing university tuition or professional courses.

- • Weddings and special occasions – covering significant expenses for important life events.

- • Business or investments – some borrowers use personal cash loans to fund small businesses or investment opportunities.

How can I apply for an instant personal loan with Tambadana?

How can I apply for an instant personal loan with Tambadana?

Applying for a loan is fast and easy. No EPF, no payslip, no bank statements – only MyKad is required. Here’s what that process looks like from start to finish:

- 1. Fill out a short application form on our website or mobile app.

- 2. Once your loan is approved, you will get an SMS from Tambadana.

- 3. Review the loan amount and loan period we can offer you. If you’re happy with the terms, sign the contract using an OTP code.

- 4. After signing the contract, your cash loan will be sent by our partners to your bank account within 24 business hours.

For a repeat loan, there’s no need to fill out a new application. Simply log in to your Tambadana account to see your personalized loan offers. Review and select the offer that best suits your needs!

How long does it take to get approved for a personal cash loan on Tambadana?

How long does it take to get approved for a personal cash loan on Tambadana?

We strive to provide a quick and efficient loan disbursement process. Once your loan is approved, we aim to process and release the funds within 24 hours. You will receive a text message (SMS) and email notification once the cash has been successfully transferred to your personal bank account.

What Is the maximum amount that can be borrowed in an immediate personal loan?

What Is the maximum amount that can be borrowed in an immediate personal loan?

The maximum loan amount depends on whether it’s your first online loan or a repeat loan with Tambadana:

- • First-time borrowers can apply for up to RM8,500.

- • Returning borrowers who have successfully repaid their previous loans can qualify for a higher amount, up to RM10,000.

This system ensures responsible lending while allowing users to increase their borrowing limit over time. If you need quick access to funds, apply now through Tambadana and receive instant approval in just 5 minutes!

Am I eligible for a loan?

Am I eligible for a loan?

Tambadana offers loan services to customers who meet the following criteria:

- • Aged between 21 and 60 years old.

- • A salaried employee with a minimum annual income of RM18,000.

- • Valid MyKad.

- • Active bank account with any bank.

- • Malaysian citizen.

These eligibility criteria are in place to ensure that the loan services are provided to individuals who meet the specified requirements.

Can I repay my personal loan earlier than the set period?

Can I repay my personal loan earlier than the set period?

Yes! Tambadana allows borrowers to repay their personal loans earlier than the agreed repayment period without any hassle. Early repayment comes with several benefits, making it a great option for those who want to clear their debt faster.

- 1. No Penalty for Early Repayment

Unlike some lenders who charge extra fees for early loan settlement, Tambadana does not impose any penalties. You can pay off your loan ahead of time without worrying about additional costs. - 2. Save on Interest

By repaying your personal loan before the due date, you can reduce the total interest paid. Since interest is calculated based on the loan tenure, an early repayment helps minimize overall borrowing costs. - 3. Improve Your Borrowing Limit

Successfully repaying your loan early can increase your borrowing limit on future applications. For example:

If you took a RM8,500 loan as a first-time borrower and repaid it early, you may qualify for a higher amount - up to RM10,000 - on your next loan. - 4. Faster Loan Processing in the Future

Early repayment builds a strong repayment history, which increases the chances of faster approvals for future loans with better terms.

By choosing Tambadana, you get the flexibility to manage your loan repayments on your own terms, without penalties or hidden fees. If you’re ready to clear your loan early, simply make a payment through our fast and secure online system!

How can I get a loan with monthly installment payments?

How can I get a loan with monthly installment payments?

It's not possible to choose the loan amount and period beforehand. Based on your application results, the system will automatically determine which loan terms we can offer you.

To check your available loan offer, please follow these steps:

- 1. Log into your account on Tambadana.

- 2. For a first-time loan: Complete the loan application to view your available offer. If the loan amount and terms suit you, proceed by signing the contract via OTP.

- 3. For a repeat loan: You can view available offers directly. If you're happy with the loan terms, proceed by signing the contract via OTP.

To qualify for a loan with a higher monthly installment amount in the future, be sure to repay your current loan in full and on time. This is crucial to building a strong credit history.

How do I check my loan status?

How do I check my loan status?

Your loan application can have one of the following statuses:

- • In Review: Your application is under review by our verification team. You will receive a decision within 2-3 business hours .

- • Approved: Your application has been approved. Once you sign the contract, the funds will be transferred to your bank account on the same day, within our business hours.

- • Rejected: Unfortunately, your application has been rejected.

I want to make a payment. What’s Tambadana’s bank account number?

I want to make a payment. What’s Tambadana’s bank account number?

Direct payments to Tambadana’s bank account are not supported. Instead, we offer secure and convenient online payment options you can choose from:

- • Bank Account: Choose ‘Bank Account’ as your payment method, select your bank, and authorize the transaction through your bank’s portal. Once completed, you'll be redirected back to Tambadana with a confirmation message.

- • E-Wallet: In your Tambadana account, go to the 'Active Loan' section and click ‘Pay now’. Select ‘E-Wallet’, choose your preferred provider, and complete the payment through the app or site.

- • DuitNow: Utilize the DuitNow app to make repayments with ease. Download the app, register your account, and follow the onscreen prompts to complete your payment.

Here's how to make a payment:

- 1. Log into Your Account: Access your account through our website or mobile app.

- 2. Click "Pay Now": Once logged in, locate and click the "Pay Now" button.

- 3. Choose a Payment Method: Select the payment method that suits you best and follow the instructions.

Can I make partial payments?

Can I make partial payments?

Yes, partial payments are allowed until the loan’s due date. However, there are a few important details depending on the type of loan:

- • Payday Loans: You must repay the full loan amount by the due date.

- • Installment Loans: You are required to pay each installment by its due date.

To help you stay on track, we offer a 3-day grace period after your due date. During this time, you can make your payment without incurring any late fees.

When is my payment due date?

When is my payment due date?

Your payment due date is the final day to make your loan payment before it's considered late. You can easily check your repayment due date by logging into your account on our website or mobile app.

We offer a 3-day grace period after your due date, giving you extra time to make your payment without being charged a late fee.