Instant Loan

- • Your overpayment is only RM5,000 x 90 x 0.05% = RM225.

- • Full payment is RM5,000+RM227.50 = RM5,225.

- • Monthly payment is only RM5,225/3 = RM1,741.67.

How to apply for a loan?

How to apply for a loan?

Step 1

Apply online

Apply online

Select your loan amount

Select your loan amount

Enter your phone number and verify via code from SMS

Enter your phone number and verify via code from SMS

Submit a short application form

Submit a short application form

Step 2

Receive approval

Receive approval

Get approved in just 5 minutes

Get approved in just 5 minutes

Confirm your details via a phone call if needed

Confirm your details via a phone call if needed

Step 3

Get your money quickly

Get your money quickly

Receive an instant money transfer

Receive an instant money transfer

Access funds from any bank account

Access funds from any bank account

- • Enter your mobile number and email

- • Fill in your personal and employment details

- • Upload the required documents and complete verification

- • Select your loan amount and repayment term

- • Sign the agreement digitally

- • Receive your money directly in your bank account – often within minutes

Am I eligible for a loan?

Am I eligible for a loan?

resident of Malaysia

employed

resident of Malaysia

employed

- • You are a resident of Malaysia

- • You are between 21 and 60 years old

- • You have a steady source of income

Why Choose Us?

Why Choose Us?

Online process

Money same day

Fully licensed

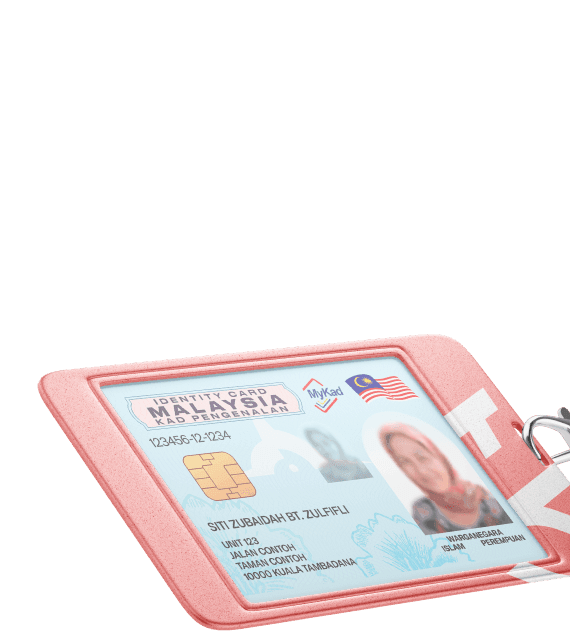

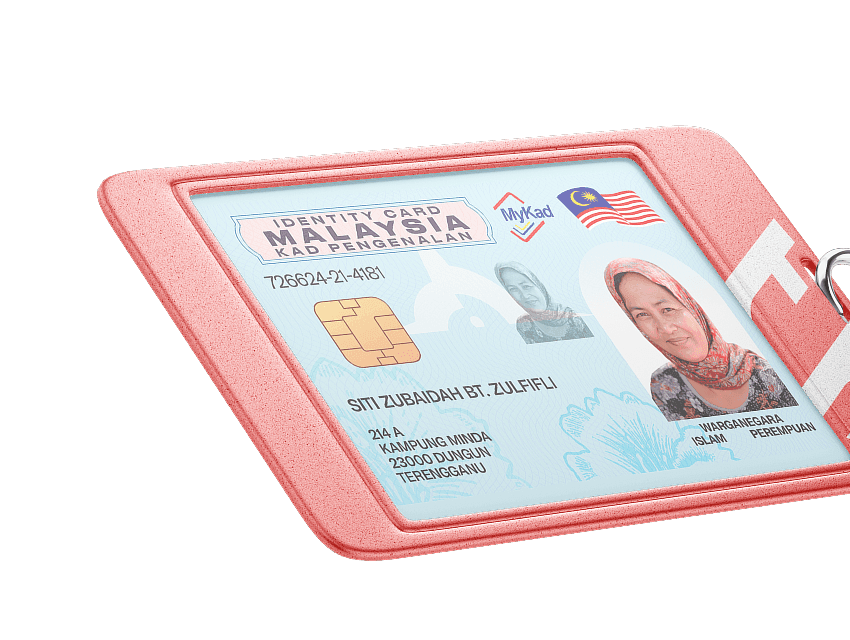

Only MyKad required

- • MyKad for identity verification

- • Recent bank statement from a Malaysia-based account

- • Basic personal and employment details

How to repay your personal loan?

How to repay your personal loan?

Step 1

Go to your loan page

Go to your loan page

Access your active loan page in your profile

Access your active loan page in your profile

Click the ‘Pay now’ button to begin

Click the ‘Pay now’ button to begin

Step 2

Choose a payment method

Choose a payment method

Select from DuitNow, ShopeePay, Touch'n'Go, GrabPay

Select from DuitNow, ShopeePay, Touch'n'Go, GrabPay

Proceed with your preferred payment option

Proceed with your preferred payment option

Step 3

Complete the payment

Complete the payment

Enter the amount you want to pay

Enter the amount you want to pay

Enter the amount you want to pay

Enter the amount you want to pay

Feedback from our customers

Feedback from our customers

License & FAQ

License & FAQ

Where can I borrow money ASAP in Malaysia?

Where can I borrow money ASAP in Malaysia?

You can apply for quick online financing through Tambadana, a licensed digital financing platform in Malaysia. The entire process is online — from application to approval — and funds are transferred directly to your bank once approved.

Can I get a RM2,000 loan instantly?

Can I get a RM2,000 loan instantly?

Yes, you can request up to RM2,000 (or more) through Tambadana’s online financing. Approval is fast and fully digital — you just need your MyKad and basic personal details. Once approved, the funds are disbursed quickly to your account.

Is P2P financing legal in Malaysia?

Is P2P financing legal in Malaysia?

Absolutely. P2P (peer-to-peer) financing is regulated by the Securities Commission Malaysia (SC). Tambadana operates under licensed partners in compliance with Malaysian laws, offering a safe and transparent way for users to access financing.

Where can I get a RM5,000 instant loan?

Where can I get a RM5,000 instant loan?

You can apply with Tambadana for financing up to RM5,000 or even RM10,000, depending on your eligibility. Everything is done online, with flexible repayment options and no need for physical visits or paperwork.