What are CCRIS and CTOS Reports in Malaysia and How Does It Affect Your Credit Score?

What are CCRIS and CTOS Reports in Malaysia and How Does It Affect Your Credit Score?

Introduction

Your credit score is one of the most influential financial tools in Malaysia, shaping how easily you can access money when you need it most. Whether you’re buying your first car, applying for a housing loan, getting a new credit card, or expanding a business, your score determines how lenders view your trustworthiness. A higher score not only improves your chances of getting approved, but it can also earn you lower interest rates and faster approval times. In Malaysia, two key systems help track and report this information: CCRIS (Central Credit Reference Information System) and CTOS (Credit Tip-Off Service).

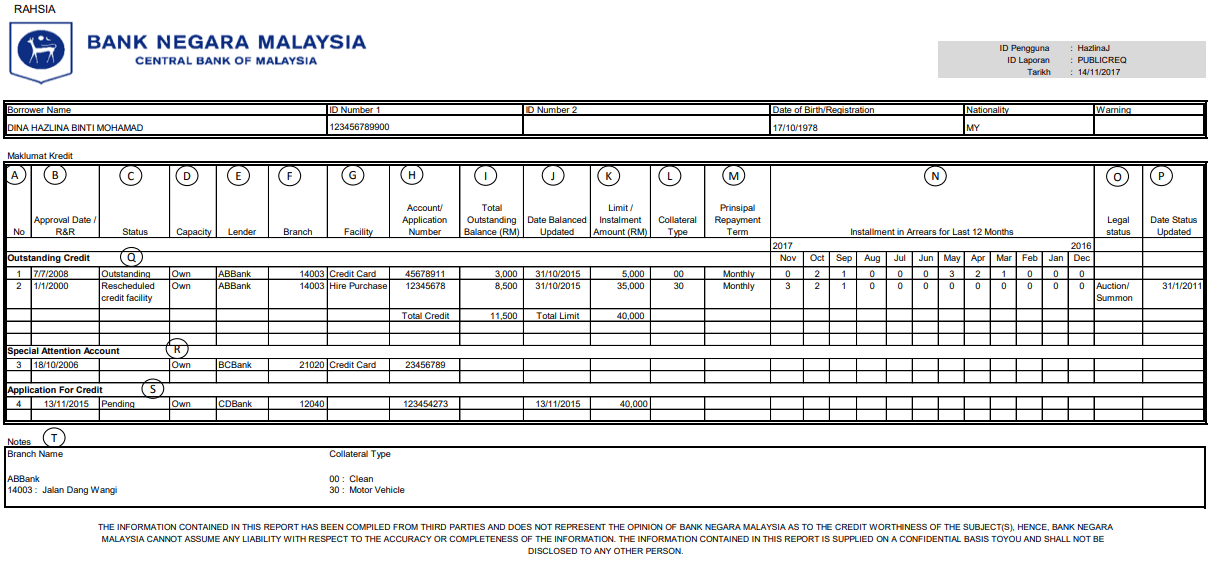

What is CCRIS report

What is CCRIS

CCRIS, or the Central Credit Reference Information System, is a database created and managed by Bank Negara Malaysia (BNM)—the country’s central bank and main financial regulator. The system was developed to promote transparency and consistency in Malaysia’s credit ecosystem by ensuring that all financial institutions share accurate information about their borrowers.

CCRIS meaning can be described as a system that acts as Malaysia’s official credit information hub. It stores detailed records of every borrower’s loan, credit card, or financing activity, including repayment behavior and outstanding balances.

Every month, participating banks, credit card issuers, cooperatives, and approved agencies submit updates about both active and closed accounts to Bank Negara CCRIS.

Because the Bank Negara CCRIS system is centralized, your CCRIS report effectively acts as a single financial identity that follows you from one financial institution to another.

A strong CCRIS record demonstrates that you make timely payments and use credit responsibly. On the other hand, inconsistent payments, overutilized accounts can raise red flags for lenders.

What is included in CCRIS report

Source of information

The CCRIS system receives direct input from:

- • financial institutions,

- • development banks,

- • and credit card providers.

Each entity submits monthly data to Bank Negara Malaysia, ensuring that updates appear consistently across the CCRIS online database. Because this process is automated, borrowers can rely on it to reflect their current repayment situation accurately.

To perform a CCRIS check online, visit the eCCRIS BNM website. You’ll need to create a CCRIS login using your MyKad and verify your email. Once registered, you can securely download your CCRIS report online anytime. Understanding how to check CCRIS online and review your data helps you stay in control of your credit profile and fix potential errors before they affect your score.

Who has access to my CCRIS report

Access to your CCRIS report is tightly controlled by Bank Negara Malaysia under data protection laws. Only three parties can legally see it:

- • You,

- • Bank Negara,

- • and financial institutions involved in your active or pending loan applications.

When you apply for a loan or credit card, the lender performs a CCRIS check to evaluate your credit record.

No employer, landlord, or outside company can view your report without explicit consent. Borrowers are encouraged to log in periodically and ensure their crediting data matches reality. If you find an outdated or incorrect entry, you can contact the reporting bank to request a correction. Regular monitoring builds transparency and improves your reputation with financial institutions.

How do I get my CCRIS report

You can obtain your CCRIS report quickly and for free. The following options are available to every borrower in Malaysia:

• Online via eCCRIS

Visit the eCCRIS BNM website to complete a secure CCRIS check online.

Follow these steps:

- 1. Go to the eCCRIS BNM website.

- 2. Click on CCRIS Login and register using your MyKad and an active email.

- 3. Verify your identity using the one-time password (OTP) sent to your phone or inbox.

- 4. Once verified, log in to view your CCRIS report online.

- 5. Download or print it for personal records or when applying for a new loan.

• In person at Bank Negara Malaysia (BNM) branches

Stop by a Bank Negara Malaysia branch or use a nearby BNM kiosk for in-person retrieval.

• By correspondence (mail, email, or fax)

Request a printed report by mail or verified email through Bank Negara’s official channels.

Each step ensures the authenticity of your request. Because updates occur monthly, performing a CCRIS check every few months lets you track how your repayment and account data evolve over time.

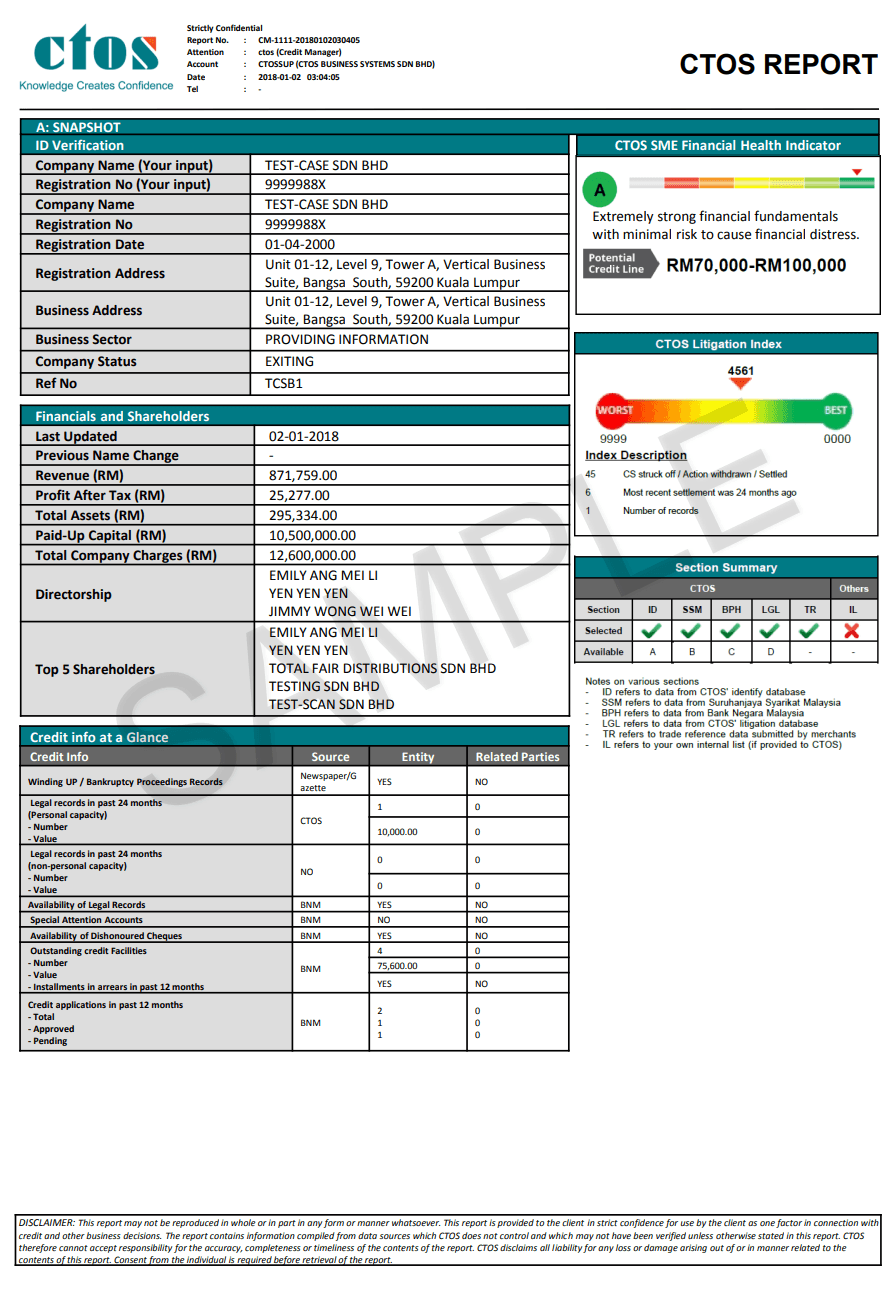

What is CTOS report

What is CTOS

CTOS is Malaysia’s largest and most widely recognized private credit bureau, operating under the authority of the Credit Reporting Agencies Act 2010. It plays a vital role in the country’s financial ecosystem by providing lenders, companies, and even individuals with accurate and updated information about a person’s credit behavior. Unlike government-run databases, CTOS functions as an independent bureau that gathers, organizes, and interprets data from multiple sources to create a comprehensive view of a borrower’s financial reliability.

The system collects data from both financial institutions and public databases, ensuring that the information it presents goes far beyond simple loan numbers. It includes details from the Companies Commission of Malaysia (SSM), Bank Negara CCRIS, the Insolvency Department, and various legal directories. This allows lenders to gain a clearer understanding of not only your repayment history but also your broader financial and professional background.

While CCRIS focuses primarily on factual and quantitative data—such as outstanding loans, repayment patterns, and open accounts—CTOS adds another dimension by analyzing the qualitative aspects of your credit life. It provides a more holistic assessment that includes your financial behavior, business interests, and even potential legal or bankruptcy activities associated with your name. This broader analysis helps financial institutions and agencies determine your overall risk level before approving a loan or credit card application.

The CTOS report acts as a single document summarizing your entire credit footprint in Malaysia. It includes your credit history, detailed repayment records, business directorships, litigation information, and your official CTOS Score.

Through the myCTOS online portal, individuals and businesses can easily register, view, and manage their credit reports at any time. The platform offers users the ability to track changes to their CTOS Score, monitor recent inquiries from financial institutions, and identify inaccuracies or outdated data that may be affecting their record. The portal also provides alerts when your credit profile is accessed or when a new loan is opened in your name, making it a valuable tool for protecting your financial identity.

One of the key advantages of CTOS is that it integrates information directly from Bank Negara CCRIS. This combination of official and public data ensures that your CTOS report gives a full and accurate picture of your crediting and repayment behavior. For lenders, it’s an indispensable resource for verifying information and assessing credit risk. For individuals, it’s an empowering way to stay informed, correct discrepancies, and take control of personal financial growth.

In essence, CTOS is more than just a credit bureau—it’s a reflection of your entire financial reputation in Malaysia. By maintaining positive repayment habits, checking your report regularly, and keeping your accounts up to date, you not only safeguard your credit health but also strengthen your position when seeking new loans or financial opportunities.

What is included in CTOS report

Source of information

The CTOS report draws from:

- • Bank Negara CCRIS,

- • SSM, the National Registration Department,

- • and public court databases.

It is one of the most trusted approved agencies under Malaysian law. Because CTOS consolidates information from both financial and public records, lenders get a clearer perspective when approving new loans or credit cards.

The combination of CCRIS Bank Negara data and CTOS analysis offers borrowers transparency. You can see not just what you owe, but also how others might interpret your financial background before making major credit decisions.

How do I check my CTOS score

Checking your CTOS report or credit score is simple using the myCTOS platform. Both desktop and mobile access are available, offering easy downloads and tracking.

Once you register, you can perform a CTOS check online, download your report, and see how your score changes over time. Reviewing your crediting history before applying for a loan helps avoid surprises and keeps your financial reputation strong.

What is the difference between CCRIS & CTOS?

CCRIS offers structured, official repayment information, while CTOS expands that view by examining legal or business-related aspects. Both are vital to financial institutions when assessing a borrower’s reliability and overall credit behavior.

Why are CCRIS & CTOS important

Both CCRIS and CTOS reports are key to maintaining a healthy credit score. Financial institutions, lenders, and agencies depend on them to decide whether to approve or decline loan applications. They also use these reports to determine appropriate interest rates or credit limits.

Lenders typically review:

- • Consistency in your repayment track record.

- • The number and size of active loans or credit cards.

- • Any legal or bankruptcy records that may increase risk.

- • The total amount of financial exposure compared with your income.

- • The age of your oldest account and average length of credit history.

- • How often you’ve been applying for new credit within a short time.

A positive record builds trust and demonstrates reliability. Borrowers who maintain good CCRIS and CTOS standing often receive faster loan approvals, higher limits, and better financial terms.

How do I get my final credit score

Your final credit score in Malaysia is derived from a combination of CCRIS and CTOS data. CTOS compiles the repayment, account, and record details from Bank Negara CCRIS to calculate your numeric score. The value usually ranges between 300 (high risk) and 850 (excellent).

A high credit score indicates strong financial management and reliable repayment patterns. Banks and financial institutions use it to evaluate your creditworthiness before approving a loan. Although Bank Negara CCRIS itself doesn’t provide a numeric score, the information it holds directly influences the figure you see on myCTOS or other approved credit bureaus.

To obtain your full credit score, log into your myCTOS account. You’ll see both your CCRIS summary and your CTOS Score in one place. Keeping your data updated through regular CCRIS checks ensures your financial reputation remains strong and reflects your current repayment discipline.

How to improve my credit score

Improving your credit score is an ongoing process that rewards consistent financial habits. Apply these strategies to strengthen your credit reputation and achieve better borrowing terms:

- • Pay all bills on time. Your repayment punctuality has the biggest impact on your credit score.

- • Avoid missed payments. Even one late loan or card payment can affect your standing.

- • Keep balances low. Maintain credit card utilization below 30% of your available limit.

- • Limit new applications. Too many simultaneous loan or card inquiries may lower your score.

- • Maintain older accounts. A long crediting history shows reliability and maturity.

- • Review your reports frequently. Conduct a CCRIS check and CTOS check online at least twice a year.

- • Clear small debts early. Paying off smaller loans improves your repayment ratio.

- • Use a mix of credit. Balancing secured and unsecured credit demonstrates financial diversity.

- • Plan spending. Keeping stable accounts and predictable expenses helps lenders trust your consistency.

- • Stay disciplined. Responsible repayment behavior today paves the way for stronger financial opportunities tomorrow.